India ITD Form No. 49AA 2018-2026 free printable template

Show details

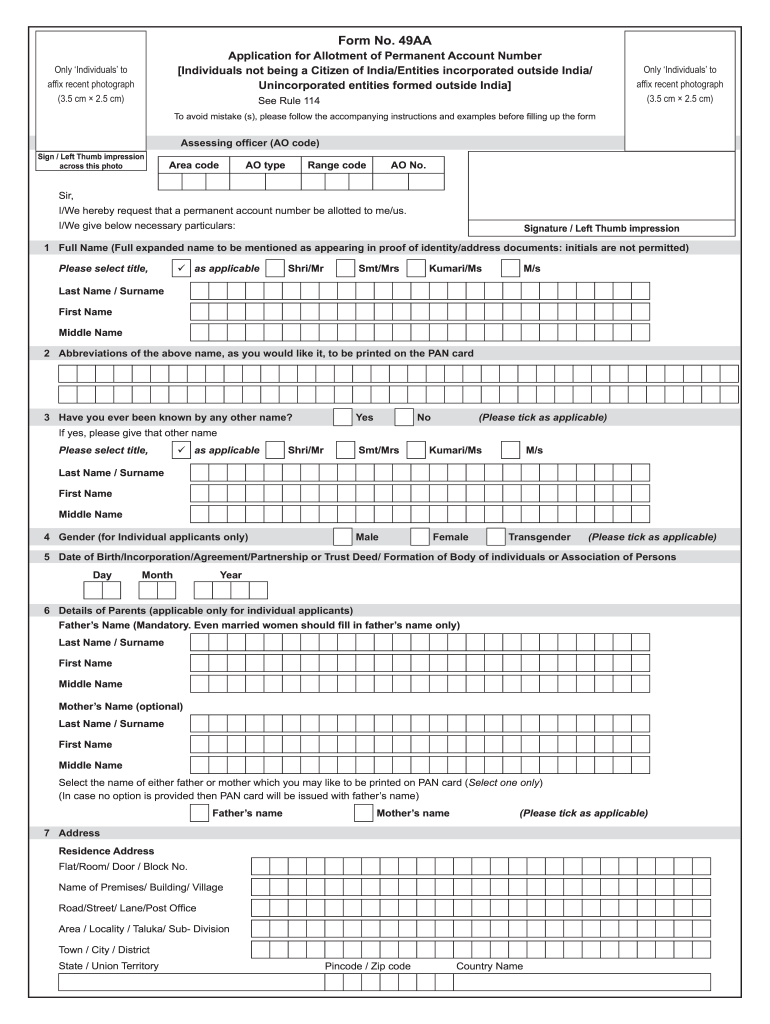

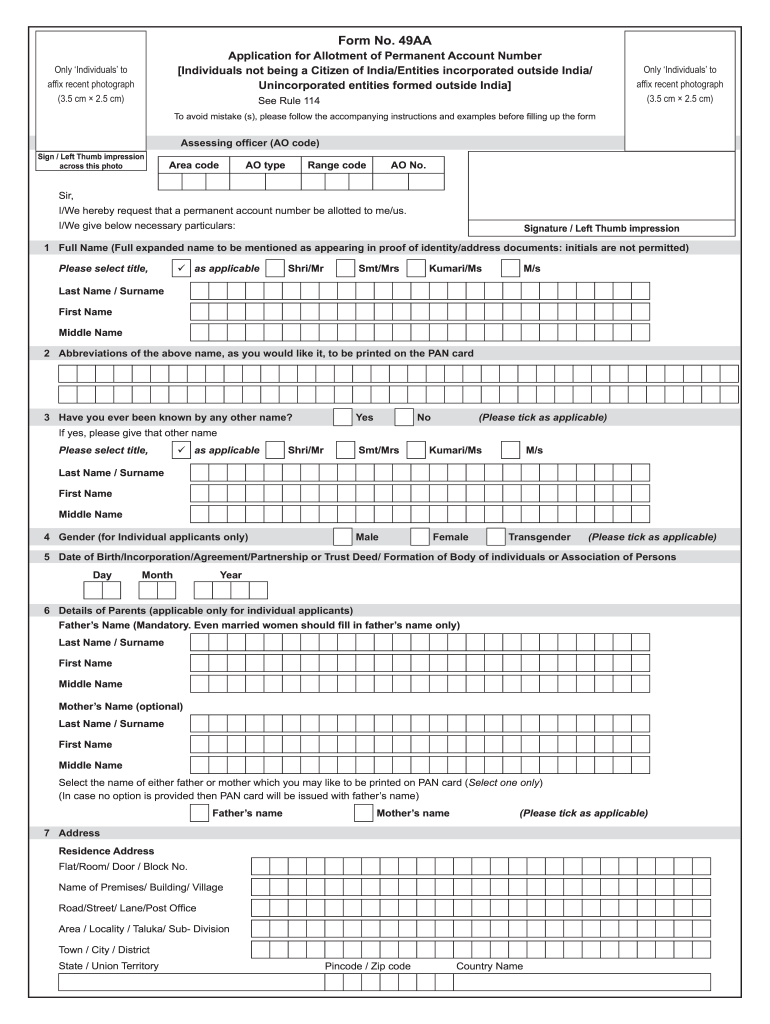

Form No. 49AA Application for Allotment of Permanent Account Number Individuals not being a Citizen of India/Entities incorporated outside India/ Unincorporated entities formed outside India Under section 139A of the Income Tax Act 1961 To avoid mistake s please follow the accompanying instructions and examples before filling up the form Assessing officer AO code Sign/ Left Thumb impression across this photo Area code AO type Range code AO No. Sir I/We hereby request that a permanent account...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 49aa editable pdf

Edit your form 49aa online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fillable form 49aa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 49aa pdf online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 49aa form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India ITD Form No. 49AA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pan card form 49aa pdf

How to fill out India ITD Form No. 49AA

01

Download ITD Form No. 49AA from the official income tax website.

02

Fill in your personal details such as name, address, and contact information.

03

Provide your date of birth and gender.

04

Indicate your nationality and other identification details as required.

05

Sign the declaration at the end of the form.

06

Submit the completed form along with any required documents to the appropriate tax authority.

Who needs India ITD Form No. 49AA?

01

Foreign entities or individuals who wish to open an account with banks in India.

02

Those who need to apply for a Permanent Account Number (PAN) from the Income Tax Department of India.

03

Foreign nationals pursuing business or investment opportunities in India.

Fill

49aa

: Try Risk Free

People Also Ask about form 49aa online pdf

Is form 49AA to be filled by foreign citizens?

Non-citizens of India should only use this form (i.e. Form 49AA) for submitting application for allotment of PAN. However, a Qualified Foreign Investor (QFI) has to apply for PAN in Form 49AA through a Depository Participant only.

Can foreigners apply for PAN card in India?

A non-resident Indian ('NRI') can apply for PAN by submitting the Form No. 49A along with the requisite documents and prescribed fees at the PAN application center of UTIITSL or Protean (formerly NSDL eGov).

How can I download PAN card 49A form?

Pan Card Form 49A can be availed from any IT PAN Service Centre (managed by UTIITSL), TIN-Facilitation Centre (TIN-FCs)/ PAN Centre (managed by NSDL e-Gov), any other stationery vendor offering such forms or may be downloaded from the UTIITSL/NSDL/ Income Tax Department website.

Can a US citizen get a PAN card?

PAN can be obtained by Indian Nationals, Foreign Nationals, Indian Entities and Foreign Entities.

How to fill PAN card form online for NRI?

One can apply for PAN by submitting the prescribed PAN application to the authorized PAN agency of the district or through online submission to NSDL along with 2 face-photos, ID proof, address proof and fee. In case of Re-print (re-issue), a photocopy of the old PAN is also required.

How to fill form 49A for PAN card online?

Steps for filing PAN application in Form 49A – 15 digit unique acknowledgment number. Category of the applicant. Permanent Account Number. Name of the applicant. Father's name (only in case of an individual). Date of birth / incorporation / agreement / partnership etc. Address for communication. Payment details.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form no 49aa download pdf online?

The editing procedure is simple with pdfFiller. Open your form 49 aa in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my form no 49aa pan card in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 49aa form pdf directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete 49aa correction form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your pan card form 49aa pdf download, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is India ITD Form No. 49AA?

India ITD Form No. 49AA is a form required by the Income Tax Department of India for individuals and entities to apply for a Tax Identification Number (TIN) or Permanent Account Number (PAN) for foreign entities.

Who is required to file India ITD Form No. 49AA?

Foreign entities or non-resident individuals who are seeking to obtain a PAN in India for tax purposes are required to file India ITD Form No. 49AA.

How to fill out India ITD Form No. 49AA?

To fill out India ITD Form No. 49AA, applicants must provide their name, address, country of origin, type of entity, and relevant identification documents, ensuring all sections are completed accurately.

What is the purpose of India ITD Form No. 49AA?

The purpose of India ITD Form No. 49AA is to serve as a formal application for foreign individuals and entities to obtain a PAN in India, which is necessary for conducting business and fulfilling tax obligations.

What information must be reported on India ITD Form No. 49AA?

The information that must be reported on India ITD Form No. 49AA includes the applicant's name, address, date of birth or incorporation, nationality, nature of the business, and relevant identification documents.

Fill out your India ITD Form No 49AA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 49aa Pan Card is not the form you're looking for?Search for another form here.

Keywords relevant to pan card 49aa form

Related to pan form 49aa pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.